Facts About Custom Private Equity Asset Managers Uncovered

Wiki Article

Excitement About Custom Private Equity Asset Managers

You've probably listened to of the term exclusive equity (PE): buying business that are not openly traded. Roughly $11. 7 trillion in assets were handled by personal markets in 2022. PE firms seek chances to gain returns that are better than what can be accomplished in public equity markets. But there might be a couple of points you do not recognize regarding the sector.

Partners at PE companies increase funds and handle the cash to yield beneficial returns for investors, generally with an financial investment horizon of in between 4 and seven years. Private equity firms have a series of financial investment choices. Some are find out here now strict financiers or passive financiers completely dependent on administration to expand the firm and create returns.

Because the most effective gravitate towards the larger bargains, the middle market is a dramatically underserved market. There are much more vendors than there are extremely skilled and well-positioned financing professionals with considerable purchaser networks and resources to handle a deal. The returns of exclusive equity are generally seen after a few years.

5 Simple Techniques For Custom Private Equity Asset Managers

Flying below the radar of huge international corporations, a lot of these small companies often offer higher-quality client service and/or particular niche items and services that are not being used by the huge empires (https://custom-private-equity-asset-managers-44593031.hubspotpagebuilder.com/custom-private-equity-asset-managers/unlocking-wealth-navigating-private-investment-opportunities-with-custom-private-equity-asset-managers). Such advantages attract the passion of exclusive equity firms, as they have the understandings and savvy to exploit such possibilities and take the business to the next degree

Many managers at portfolio companies are offered equity and reward compensation frameworks that reward them for hitting their financial targets. Private equity chances are commonly out of reach for people who can't invest millions of dollars, but they should not be.

There are laws, such as limits on the aggregate amount of money and on the number of non-accredited capitalists (Private Equity Firm in Texas).

The Main Principles Of Custom Private Equity Asset Managers

Another disadvantage is the absence of liquidity; as soon as in a private equity deal, it is not simple to obtain out of or sell. With funds under management already in the trillions, private equity companies have come to be attractive investment vehicles for affluent individuals and organizations.

Currently that access to exclusive equity is opening up to more specific financiers, the untapped potential is ending up being a truth. We'll start with the primary arguments for investing in private equity: How and why private equity returns have actually historically been greater than various other properties on a number of degrees, Just how including private equity in a profile impacts the risk-return profile, by assisting to diversify versus market and cyclical threat, Then, we will detail some essential considerations and dangers for exclusive equity capitalists.

When it involves introducing a brand-new asset right into a portfolio, the a lot of basic consideration is the risk-return profile of that property. Historically, personal equity has exhibited returns similar to that of Arising Market Equities and greater than all various other conventional asset classes. Its fairly reduced volatility paired with its high returns creates a compelling risk-return profile.

Our Custom Private Equity Asset Managers Diaries

Exclusive equity fund quartiles have the best array of returns throughout all different asset courses - as you can see listed below. Approach: Interior rate of return (IRR) spreads calculated for funds within vintage years independently and afterwards balanced out. Typical IRR was computed bytaking the standard of the mean IRR for funds within each vintage year.

The takeaway is that fund selection is critical. At Moonfare, we accomplish a rigorous selection and due persistance procedure for all funds listed on the platform. The impact of adding exclusive equity into a profile is - as constantly - depending on the profile itself. A Pantheon study from 2015 recommended that consisting of exclusive equity in a portfolio of pure public equity can open 3.

On the various other hand, the finest exclusive equity firms have access to an even bigger pool of unknown opportunities that do not face the very same scrutiny, as well as the sources to carry out due persistance on them and determine which are worth purchasing (Private Equity Platform Investment). Investing at the first stage indicates higher danger, but also for the companies that do prosper, the fund benefits from higher returns

Custom Private Equity Asset Managers Fundamentals Explained

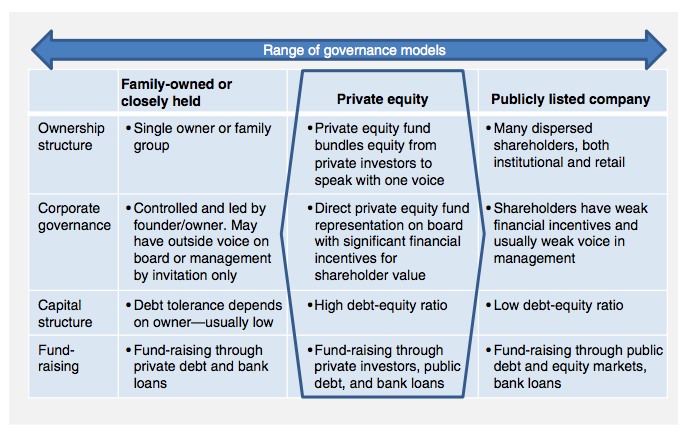

Both public and personal equity fund managers dedicate to investing a portion of the fund yet there continues to be a well-trodden problem with lining up passions for public equity fund monitoring: the 'principal-agent issue'. When an investor (the 'major') hires a public fund supervisor to take control of their capital (as an 'agent') they entrust control to the manager while maintaining ownership of the properties.

In the case of private equity, the General Companion does not just gain an administration cost. Private equity funds likewise alleviate one more type of principal-agent issue.

A public equity investor inevitably wants one thing - for the monitoring to boost the stock price and/or pay out dividends. The financier has little to no control over the choice. We showed over the amount of private equity strategies - specifically bulk acquistions - take control of the running of the company, making certain that the long-term worth of the company comes first, raising the return on investment over the life of the fund.

Report this wiki page